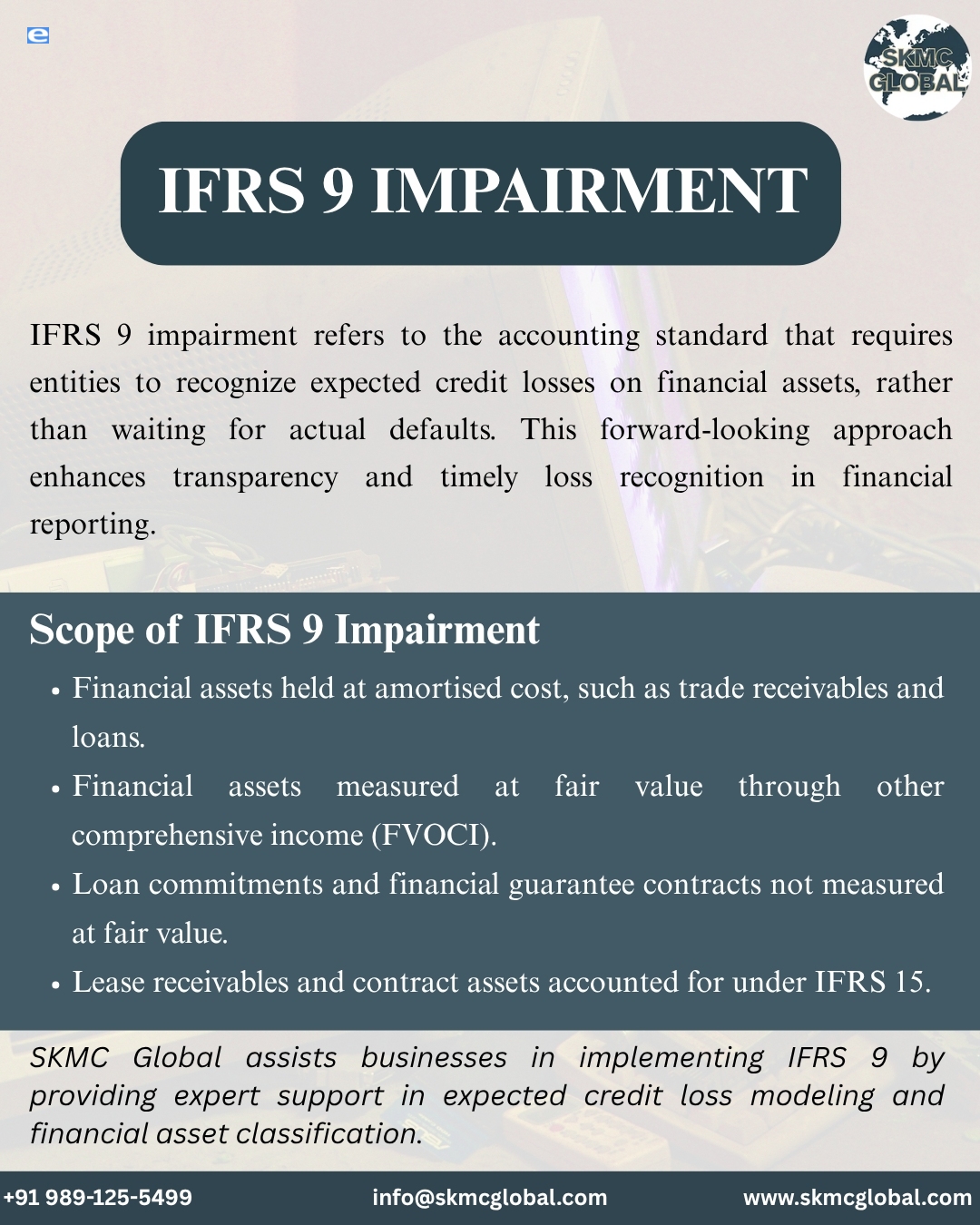

IFRS 9, introduced by the IASB, replaced the "incurred loss" model of IAS 39 with a forward-looking Expected Credit Loss (ECL) approach, significantly reshaping how credit losses are recognized. This shift, driven by the 2008 financial crisis, ensures earlier and more transparent recognition of financial risks. IFRS 9 impairment applies to financial assets, requiring businesses to proactively assess and provide for potential credit losses. While it demands more data, judgment, and disclosure, it enhances the quality of financial reporting and supports better risk management in today’s dynamic economic landscape.